22+ paycheck calculator missouri

Our paycheck calculator is a free on-line service and is available to everyone. Its a progressive income tax meaning the more.

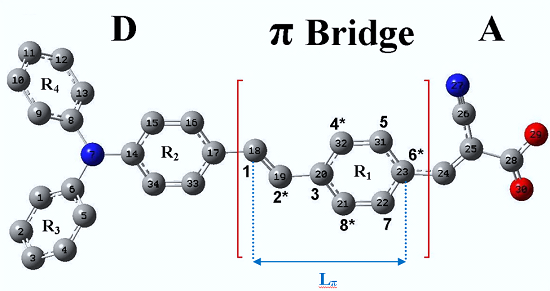

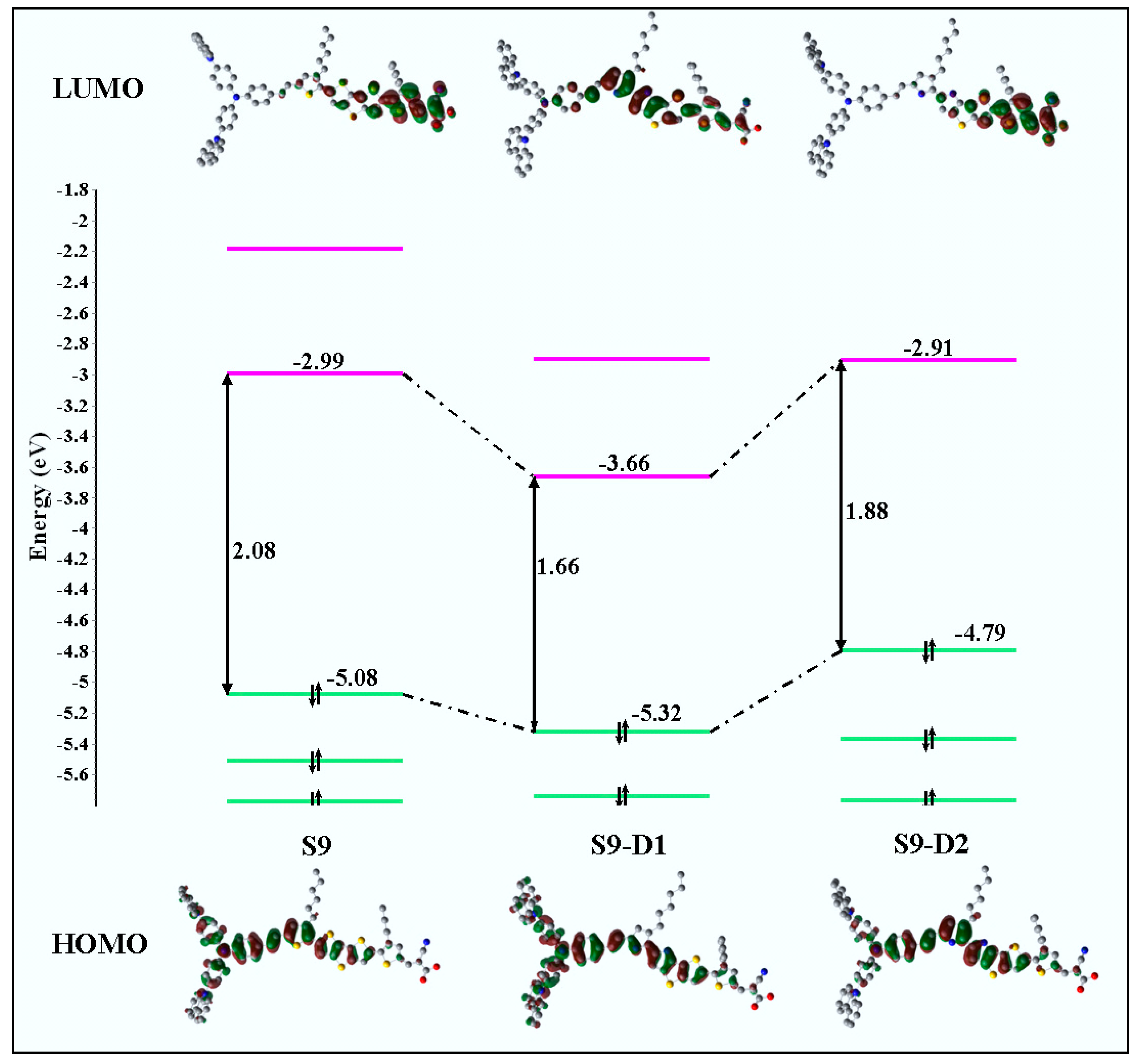

Materials Free Full Text Methodologies In Spectral Tuning Of Dssc Chromophores Through Rational Design And Chemical Structure Engineering Html

Calculating paychecks and need some help.

. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Employers can use the calculator rather than manually looking up. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Then multiply that number by the total number of weeks in a year 52.

Missouri Salary Paycheck Calculator. The Missouri Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Missouri State. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4.

Multiply the hourly wage by the number of hours worked per week. This Missouri hourly paycheck. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Ad Compare Prices Find the Best Rates for Payroll Services. Missouri tax year starts from July 01 the year before to June 30 the current year. For example if an employee makes 25 per hour and.

This tool has been available since 2006 and is visited by over 12000. You are able to use our Missouri State Tax Calculator to calculate your total tax costs in the tax year 202223. Our calculator has recently been updated to include both the latest Federal Tax.

It is not a substitute for the advice of. The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15. Additions to Tax and Interest Calculator.

Use ADPs Missouri Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Missouri. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Missouri residents only.

Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. Follow the steps on our Federal paycheck. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

Just enter the wages tax withholdings and other information required. Make Your Payroll Effortless and Focus on What really Matters. Enter your info to see your take home pay.

No personal information is collected.

Paycheck Calculator Take Home Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Missouri Paycheck Calculator Smartasset

E7 Retirement Pay Use The Military Retirement Calculator

Missouri Salary Calculator 2022 Icalculator

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

Robust And Efficient Implicit Solvation Model For Fast Semiempirical Methods Journal Of Chemical Theory And Computation

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Materials Free Full Text Methodologies In Spectral Tuning Of Dssc Chromophores Through Rational Design And Chemical Structure Engineering Html

2190 Ray Dr Pacific Mo 63069 Realtor Com

Lucas Hunt Village Apartments 5303 Lucas Hunt Road St Louis Mo Rentcafe

Am I Doing This Right R Workreform

Missouri Salary Paycheck Calculator Gusto

Missouri Payroll Paycheck Calculator Missouri Payroll Taxes Payroll Services Mo Salary Calculator

Missouri Wage Calculator Minimum Wage Org

Poker Ranges Range Reading In 2022 Splitsuit Poker

Buy Galaxy S22 Ultra Price Promotion Samsung Singapore