Rmd calculator for 2022

If you turned 70½ in 2019 the old rule applies. Opening an IRA May Help Meet Goals of Investing for Income or Growth.

How To Calculate Required Minimum Distribution Rmd Smartasset Annuity High Yield Savings Saving For Retirement

Ad Explore Tools That Allow You To Access Insights On Retirement Concerns.

. How To Calculate Rmd For 2022Ira required minimum distribution rmd table for 2022 rmds must be taken by age 705 if you were born before july 1 1949 or by age 72 if you were born. AARP Updated May 2022 Required Minimum Distribution RMD Use this calculator to determine your Required Minimum Distribution RMD. The IRS requires that you withdraw at least a.

The first RMD must be taken by April 1 of the year after you turn age 72. Account balance as of December 31 2021 7000000 Life expectancy factor. Pauls first RMD is due by April 1 2022 based on his 2020 year-end balance.

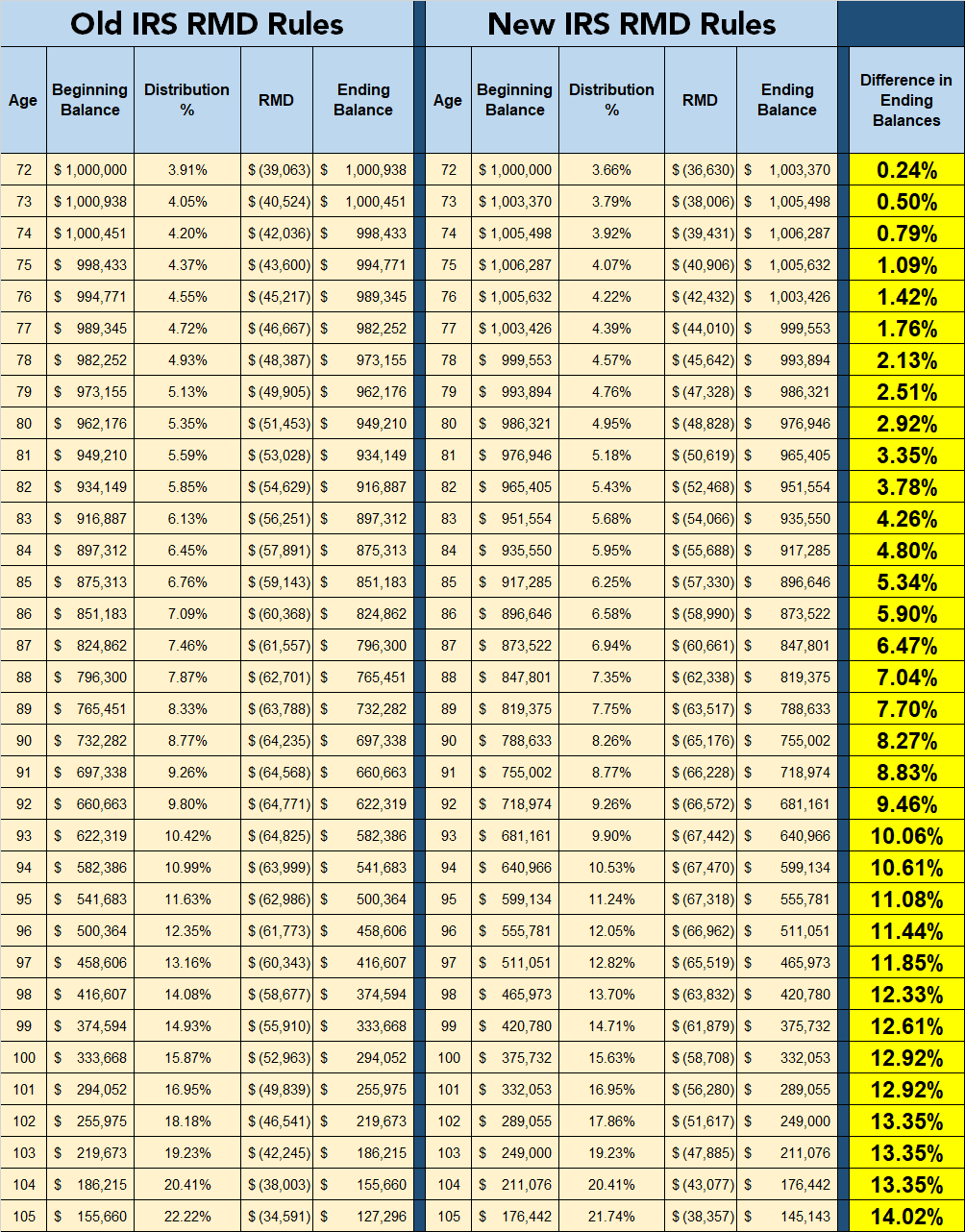

Access Schwab Professionals 247. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. The IRS implemented new Life Expectancy Tables on January 1 2022 for use in calculating required minimum distributions from accounts that qualify.

FMV as of Dec. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on. Calculate your required minimum distributions RMDs The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and.

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. The RMD Calculator is not available right now. Its equal to 50 percent of the amount you were supposed to withdraw.

Paul must receive his 2022 required minimum distribution by December 31 2022 based on his. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. How is my RMD calculated.

Effective 112020 the SECURE Act increased the starting age for required minimum distributions from 70½ to 72. This calculator has been updated to reflect the new figures. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

To calculate the required minimum distributions you must first check the IRS Publication 590 which has the RMD table. If you need to calculate your 2021 RMD please call T. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

Ad Use This Calculator to Determine Your Required Minimum Distribution. Ad If you have a 500000 portfolio download your free copy of this guide now. 1 Use FINRAsRequired Minimum Distribution Calculator to calculate your current years RMD.

All this site does is calculate Required Minimum Distributions. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

Rowe Price at 1-888-421-0563. You must calculate your RMD. Opening an IRA May Help Meet Goals of Investing for Income or Growth.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. The SECURE Act of 2019 changed the age that RMDs must begin. Use this calculator to determine your required minimum distributions RMD from a traditional IRA.

Find a Dedicated Financial Advisor Now. Helps IRA beneficiaries calculate the required minimum. If you turned 72 in June 2022 you have.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. Owner date of birth. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

Spouse date of birth optional Calculate. Your first RMD will. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

0 Your life expectancy factor is taken from the IRS. Clients can log in to view their 2022 T. Get The Flexibility Visibility To Spend W Confidence.

Connect With A Prudential Financial Professional Online Or By Phone. If you were born on or after. Ad Do Your Investments Align with Your Goals.

The IRS calls that the required beginning date. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Calculate the required minimum distribution from an inherited IRA.

The SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for. The IRS has published new Life Expectancy figures effective 112022. Then you must track down your age on the.

Not Just For The Rich These Strategies Can Help Lower Your Taxes Cnbc Retirement Financial Planning Helpful Strategies

Did I Just Retire At Age 52 Video In 2022 White Coat Investor Retirement Planning Early Retirement

What S My Projected Required Minimum Distribution The Motley Fool

News You Should Know Irs Changing Rmd Rules For 2022 Pera On The Issues

New Rmd Calculations For Retirees In 2022 And Beyond Youtube

Required Minimum Distribution Rules Rmd Wealth Management Pittsburgh

Irs Change Will Decrease Rmds Beginning In 2022 Level Financial Advisors

Changes To Required Minimum Distributions In 2022 Fswa Blog

Good News For Retirees Rmd Formula Changing For First Time In Decades In 2022 Budget Calculator Financial Decisions Money Saving Tips

Irs Change Will Decrease Rmds Beginning In 2022 Level Financial Advisors

Required Minimum Distribution Calculator

5 Best Retirement Calculators Which Are Totally Free Financial Freedom Countdown

Irs State Tax Calculator 2005 2022

What You Need To Know About 2022 Rmds Quantum Financial Planning Services Inc

How An In Service 401 K Rollover Works Smartasset

Inherited Ira Rmd Calculator Td Ameritrade

Calculate Your Required Minimum Distribution From Iras Kiplinger